The coalition of states challenging President Biden’s $400 billion student loan handout has filed written response to the U.S. Supreme Court after the government sought to have the lawsuit thrown out.

In court documents filed Wednesday, Nebraska and five other states argue that Biden’s invocation of a national emergency to forgive a portion of federal student loan debt is an “unlawful” abuse of the Higher Education Relief Opportunities for Students (HEROES) Act of 2003. The response comes after the Biden administration last week filed its emergency request with the Supreme Court to vacate a federal appeals court’s injunction blocking the student loan forgiveness program from taking effect.

“The Act requires a real connection to a national emergency. But the Department’s reliance on the COVID-19 pandemic is a pretext to mask the President’s true goal of fulfilling his campaign promise to erase student-loan debt,” the states wrote in their response.

“Hiding the real motive, the agency attempts to connect the Cancellation to the pandemic by citing current economic conditions supposedly caused by COVID-19. But those conditions are not directly attributable to the pandemic, so the Department has failed to adequately link the Cancellation to a national emergency,” they said.

WHITE HOUSE EXTENDS STUDENT LOAN PAYMENT PAUSE THROUGH JUNE 2023 DESPITE BIDEN PLEDGE

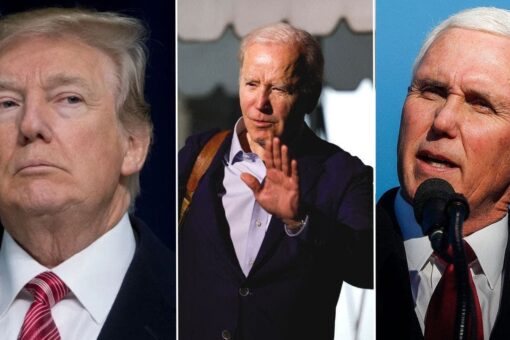

President Biden speaks during a news conference at the White House, Aug. 24, 2022.

(Bonnie Cash/UPI/Bloomberg via Getty Images)

The Biden administration now has the opportunity to file a final reply brief, then the court would be poised to issue an order. That could happen in coming days.

On Nov. 18, the government filed an emergency request with the Supreme Court to vacate a lower court’s injunction blocking the student loan forgiveness program from taking effect.

The White House argues both that the states behind the legal challenge don’t have actual standing to bring the case, and also that they would win on the merits. The federal government argues the action is within its authority.

In its request, the Biden administration repeatedly stated the loan forgiveness plan must be allowed to proceed because borrowers are currently stuck in financial limbo.

BIDEN STUDENT LOAN HANDOUT TO COST MORE THAN $400 BILLION: CBO

Supreme Court of the United States

(AP Photo/Patrick Semansky)

The administration told the court that borrowers eligible for loan forgiveness have come to expect they will receive $200 to $300 reductions in monthly payments. “Yet because of the injunction, the borrowers most likely to default if payment obligations resume without some relief face prolonged uncertainty about the scope of their payment obligations and when those obligations will resume.

“So long as that uncertainty continues, many borrowers will lack information they need to decide whether they can afford to change jobs, buy a home or a car, or assume other long-term financial obligations,” the Biden administration asserted.

In Wednesday’s filing, the states claimed they would face a “wave of harms” should the injunction be lifted.

“In contrast to the Department’s absence of any immediate injury, lifting the injunction risks unleashing on the States a wave of harms that could not be undone because of the Cancellation’s ‘irreversible impact.’ … Given this lopsided balance, the Court should deny the Department’s request to vacate the Eighth Circuit’s injunction,” the states wrote.

FIRST LAWSUIT FILED TO BLOCK BIDEN’S STUDENT LOAN HANDOUT

Demonstrators rally in front of The White House to celebrate President Biden canceling student debt and to begin the fight to cancel any remaining debt on Aug. 25, 2022.

(Paul Morigi/Getty Images for We the 45m)

Biden announced in August that he will hand out $10,000 of federal student loan debt relief for certain borrowers making less than $125,000 per year and up to $20,000 for Pell Grant recipients.

Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina proceeded to sue the administration, arguing the president does not have the authority to unilaterally forgive student loans.

CLICK HERE TO GET THE FOX NEWS APP

The president has said he is “confident” that his “student debt relief plan is legal.”

Fox News’ Brook Singman, Peter Doocy, and Patrick Ward contributed to this report.