President Biden routinely boasts about reducing the annual budget deficit, but a closer look at the numbers shows that the drop in emergency COVID spending has masked a massive amount of new spending that will present a significant fiscal challenge for Biden and his successors.

“The talk about how we’re spending all this money and all this social spending — the irony is that we have reduced the deficit in my first year by $350 billion,” Biden said on Oct 6. “We still have a gigantic accumulated debt overall, but we’ve reduced the actual yearly deficit by $350 billion; this year, by a trillion dollars.”

On the surface, Biden is correct. The government’s budget deficit — the amount by which government spending exceeds revenues — was $3.1 trillion in fiscal year 2020, $2.8 trillion in fiscal year 2021, and it will likely be about $1 trillion in fiscal year 2022, which ended Sept. 30.

But while falling deficits generally imply improving fiscal health, Biden is approving new spending programs almost as fast as the temporary COVID-era relief programs expire. Budget experts say the decisions Biden made in 2021 and 2022 will cause major fiscal problems that will start to be seen in 2023, and they say the numbers show Biden is not the deficit hawk he claims to be.

NATIONAL DEBT SURPASSES $31 TRILLION

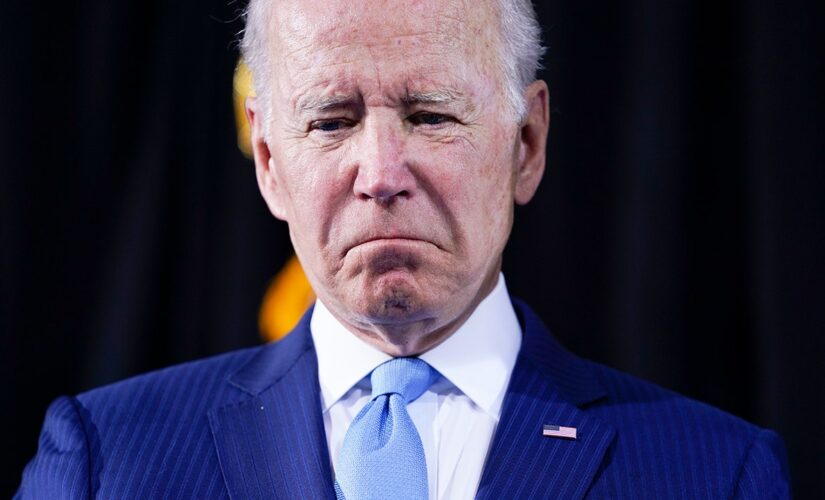

President Biden has trumpeted deficit reduction under his administration, but outsized spending could soon send deficits higher again.

(AP Photo/Evan Vucci)

2021

The high-water mark for federal spending was 2021. Biden signed the $1.9 trillion American Rescue Plan into law, and the government would spend a record $6.8 trillion.

The government did eke out a $350 billion reduction in the budget deficit compared to 2020, but it was not because spending was reduced as Biden has implied. According to Treasury Department data, the government spent $300 billion more in 2021 than it did a year earlier, and the deficit fell only because of a surprise surge in tax revenue.

As a result, the final $2.8 trillion budget deficit was $600 billion more than anticipated by experts at the nonpartisan Congressional Budget Office (CBO).

2022

2022 is the year in which Biden has claimed his biggest victory — a reduction in the budget deficit of more than $1 trillion.

But fiscal year 2022 is also the year in which Biden essentially replaced COVID spending with non-COVID spending and ensured total outlays didn’t stray too far from their COVID peak. He signed the $1 trillion infrastructure bill, the $750 billion Inflation Reduction Act, the $280 billion CHIPS Act, a wave of Ukraine funding bills totaling $65 billion, and other bills that will add nearly $5 trillion to the national debt over the next decade.

Treasury Secretary Janet Yellen has overseen a rising federal debt load that will soon cost more to service.

(Reuters/Clodagh Kilcoyne)

In 2021, CBO estimated that the government would spend $5 trillion in 2022. Midway through the year, CBO put that estimate at $5.8 trillion because of all the new spending that was authorized.

By end of fiscal year 2022, the government had only cut back on about $1 trillion of the $2.5 trillion spending boost that happened under COVID, and budget hawks said that decline isn’t nearly enough to justify Biden’s claim of fiscal prudence.

“Once the economy was strong enough, Congress and the White House should have stopped engaging in new borrowing and pivoted to focusing on implementing reforms to slow the growth of the national debt,” the Committee for a Responsible Federal Budget said in September.

2023

This new fiscal year, which began Oct. 1, could be one in which the long-term fiscal burden of Biden’s spending choices becomes evident.

First, most of the cost of Biden’s recent student loan handout will likely hit this year. CBO said it could cost $400 billion in total, while private sector analysis have said it could be much higher. Whatever the number, the bulk of it will be counted as new government debt in the next few months.

So, while spending for this current year was expected to be $5.8 trillion, it will likely rise to $6.2 trillion or more.

Secretary of Education Miguel Cardona will soon implement President Biden’s $500 billion student loan handout.

(ReutersEvelyn Hockstein)

Secondly, rising interest rates mean the government will pay more to service its $31 trillion debt. The government spent $471 billion on net interest payments on the debt in the first 11 months of fiscal year 2022, and the final number will likely eclipse $500 billion when the year-end numbers arrive.

WHITE HOUSE SUGGESTS BIDEN’S $500B STUDENT LOAN HANDOUT WILL BE PAID FOR WITH DEFICIT SPENDING

Experts say that as more federal debt becomes subject to higher interest rates over the next year, the cost of servicing the debt could rise by hundreds of billions of dollars. Trillions of dollars in government debt will have to be “rolled over” — or paid for with new debt that will bear higher interest rates.

“Our problems are going to come from the interest payment side of this,” said Veronique de Rugy, a senior research fellow at the Mercatus Center at George Mason University. “Payment on the debt is already growing quite significantly and is going to continue because the debt is growing, and interest rates are going up.”

CLICK HERE TO GET THE FOX NEWS APP

De Rugy says all of this sets Biden up for a new budget deficit crisis, which could happen if the economy cools and tax revenues fall off — a distinct possibility given that the U.S. already appears to be in a mild recession and the Federal Reserve continues to raise rates in an effort to tamp down inflation.

“All you need [is] a weaker economy, less tax receipts and much higher interest rates, which will materialize in much higher interest payments,” she said. “And then you really have a problem.”

The White House declined to provide comment for this story.