NEWYou can now listen to Fox News articles!

House Democrats on Thursday objected to a Republican request for information on how much it’s costing taxpayers to forgive student loans held by government workers.

The House Committee on Education and Labor met Thursday to consider a Republican resolution that asks the Department of Education for a range of information on the cost of two loan forgiveness policies that only benefit people who work in the public sector. The changes are expected to result in billions of dollars in student loan debt relief for eligible government workers.

But Democrats in the committee opposed the resolution and reported it to the House with an adverse recommendation, a sign it has no chance of passage in the Democratic-led House. The committee also opposed a related resolution asking the department to explain how it has the legal authority to transfer the burden of federal student loan debt to taxpayers.

The committee decision came after a debate in which Republicans said the Biden administration is violating the law that should continue to govern student loan forgiveness programs.

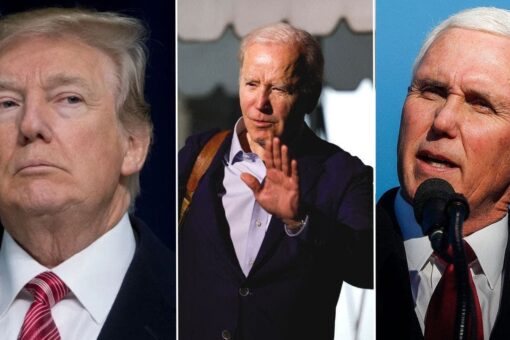

President Biden speaks on student loan debt at the White House, Aug. 24, 2022.

(Alex Wong/Getty Images)

“President Biden is making radical changes to the student loan program through executive fiat and must be held accountable,” said Rep. Virginia Foxx, R-N.C., at the committee meeting. “What is happening now is the law is not being followed as it was written, and that’s one of the reasons we feel so keenly that this is an illegal act on the part of the president.”

Rep. Mariannette Miller-Meeks, R-Iowa, said outside estimates put the cost as high was $145 billion, and reminded them that this level of loan forgiveness will be borne by taxpayers.

“It’s the American people who pay for loan forgiveness, not the administration,” she said. “It’s time to call these actions what they are: retroactive free college.”

Rep. Glenn Grothman, R-Wis., said the gift to government workers is a sign that Democrats favor the public sector over the private sector.

Rep. Virginia Foxx called the proposed student loan handouts “an illegal act on the part of the president.”

(Samuel Corum/Bloomberg via Getty Images)

“We talk a lot about equality or equity around here,” he said. “Let’s look at what we are doing here as far as the preferred classes and the hated classes who don’t benefit from this program.”

Grothman added that people aren’t eligible for the forgiveness programs if they work for the private sector, “which is really the sector that makes the country go around. I always feel in that program there’s a little bit of hatred directed at the manufacturing sector, agriculture sector, retail sector.”

Democrats broadly rejected the GOP attempt to wrestle cost data out of the federal government and noted that Republicans have made it clear they want to do away with the program that helps government workers.

“Now [that] the administration has sought to use their authority whenever possible to ease the burden of student debt on all the working, taxpaying Americans and their families, [Republicans are] using this resolution, which will have the effect of bogging down the administration with extraordinary production requests in the name of oversight,” said Rep. Bobby Scott, D-Va.

The U.S. Department of Education in Washington, D.C.

(Stefani Reynolds/AFP via Getty Images)

The Department of Education made two major decisions over the last year that will help government workers reduce their student loan debt. The first came in October 2021, when the department temporarily waived some restrictions in the Public Service Loan Forgiveness program (PSLF).

ELIZABETH WARREN INSISTS BIDEN’S STUDENT LOAN HANDOUT IS ‘GOOD FOR OUR ECONOMY’

PSLF is designed to help “teachers, nurses, firefighters, and others serving their communities,” according to the department. Under the program, public sector workers who make qualifying student loan payments for 10 years have their federal student loan debt forgiven.

The department said the program was underused, in part because of the rules describing which payments qualify. To boost participation, the department temporarily waived many of these rules and estimated that more than 550,000 people will benefit from the changes.

President Biden, with Education Secretary Miguel Cardona, announces his plan for student loan relief on Aug. 24, 2022, at the White House.

(Olivier Douliery/AFP via Getty Images)

As a result of the change, the department estimated that 22,000 would be eligible for the immediate discharge of their student loan obligations that total $1.74 billion.

CLICK HERE TO GET THE FOX NEWS APP

In April 2022, the department announced it would help PSLF borrowers who may have been inappropriately steered into a loan forbearance program in violation of department rules, instead of an income-driven repayment system. It said this move would result in the immediate cancellation of student loan debt for at least 40,000 people.

Last month, the Biden administration announced a much broader plan for reducing student loans, one that applies to everyone, not just public sector workers. On Aug. 24, the White House said it would forgive $20,000 in loan debt for people who received Pell Grants, as long as they earn less than $125,000 individually or $250,000 as part of a household.

Borrowers who didn’t receive a Pell Grant will get $10,000 in debt relief if they meet the same income thresholds.