NEWYou can now listen to Fox News articles!

Two House Democrats facing tough re-election bids are defending their party’s expansion of the Internal Revenue Service (IRS) that was included in the Manchin-backed Inflation Reduction Act, which does little to immediately address inflation.

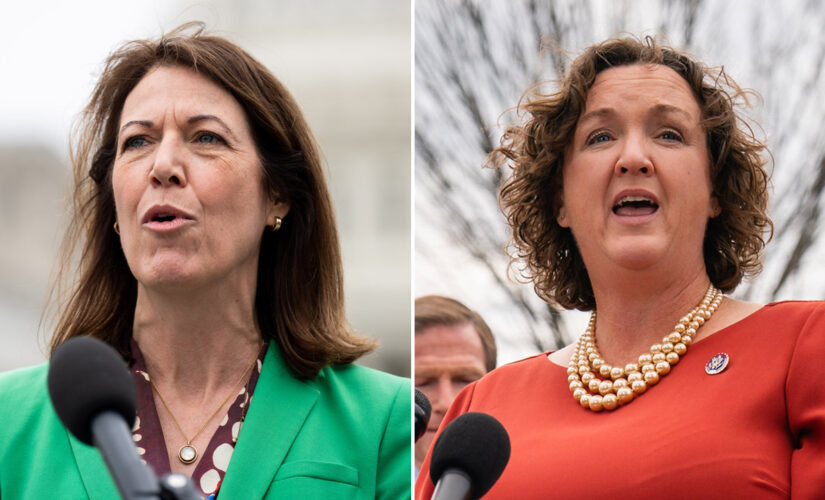

The two vulnerable Democratic congresswomen, Rep. Katie Porter of California and Rep. Cindy Axne of Iowa, are defending the Inflation Reduction Act and their votes in favor of the measure that will grant an $80 billion boost to the IRS over a 10-year period, with more than half of the funds intended to help the agency crack down on tax evasion.

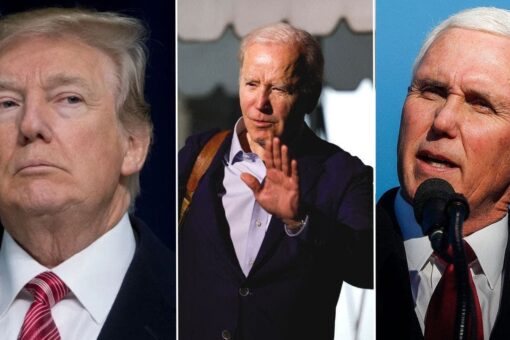

The billions of dollars for the IRS from the measure, which was signed into law on Tuesday by President Biden, will go toward filling 87,000 IRS positions, more than doubling the agency’s current size.

“We’re investing in the IRS because right now, $160 billion in taxes go unearned into our country’s coffers that would help all of you with our schools, and with our roads, and with our healthcare, and with all of the important things this country needs because we don’t have enough IRS auditors to address the issues that we’re facing,” Axne, who has served in Congress since 2018, said at a recent event put on by the Des Moines Register.

Democratic Reps. Cindy Axne of Iowa and Katie Porter of California.

(Eric Lee/Bloomberg, Bill Clark/CQ-Roll Call, Inc via Getty Images)

“So, what happens is folks like Gary” — referring to someone in the audience — “is gonna stand a better chance of getting audited, you know, than Elon Musk,” Axne added. “And so, we’ve gotta make sure that we’re addressing this across the country, so I voted for that bill.”

Similarly, Porter, who has represented California’s 45th Congressional District in the House since 2019, insisted during a recent appearance on MSNBC that Americans “would like to have” more agents within the IRS and that the “thrust of the bill is bringing down costs for American families in the short term.”

Porter said the GOP’s claim that the additional IRS agents will target Americans making less than $75,000 a year is a “load of malarkey” and “just not true.”

“I get phone calls every day from my constituents and colleagues around the country, asking for help with federal agencies that are not being responsive, that they are waiting on answers from,” Porter said. “The number one agency that the American people would like to have — have more agents, be more helpful, pick up the phone, build better technology, be more responsive — is the IRS.”

MOST AMERICANS WILL FEEL TAX PAIN FROM DEM INFLATION BILL DESPITE BIDEN’S PAST PROMISES: ANALYSIS

The U.S. Capitol dome is lit by the morning sun.

(Bill Clark/CQ-Roll Call, Inc)

“This is an investment in allowing the IRS to modernize and prepare for the wave of anticipated retirements in customer service agents that we are already facing,” Porter added. “The audit piece of this is focused on big corporations and that’s exactly why you’re hearing Republicans who are beholden to those big corporations try to weaken and attack this piece.”

Both Axne and Porter, who advanced from their Democratic primary elections in June, will face off against Republican challengers in the November general election for their states. Axne is being challenged by former Iowa state House Republican Rep. Zach Nunn, while Porter faces a challenge from Republican Scott Baugh, a graduate from Liberty University.

Prior to the House’s passage of the measure, Senate Democrats projected that enhancing IRS funding could add an extra $124 billion in federal revenue over the next decade by hiring more tax enforcers who can crack down on rich individuals and corporations attempting to evade taxes.

The Internal Revenue Service federal building in Washington D.C.

(iStock)

CLICK HERE TO GET THE FOX NEWS APP

However, Republicans warned the bill would fund an “army” of IRS agents to crack down on small business owners and lower-income workers. Americans who earn less than $75,000 per year are slated to receive 60% of the additional tax audits expected under the Democrats’ spending package, according to an analysis released by House Republicans.

House Republican analysis showed that individuals with an annual income of $75,000 or less would be subject to 710,863 additional IRS audits, while those making more than $1 million would receive 52,295 more audits under the bill.

Overall, the IRS would conduct more than 1.2 million more annual audits of Americans’ tax returns, according to the analysis. Another 236,685 of the estimated additional audits would target individuals with an annual income between $75,000 and $200,000.

Fox News’ Jessica Chasmar contributed to this report.