NEWYou can now listen to Fox News articles!

Senate Majority Leader Chuck Schumer and Sen. Joe Manchin’s reconciliation bill, the Inflation Reduction Act, is deceptively named since it will actually exacerbate Americans’ pain from inflation while simultaneously raising taxes, an economist told Fox News.

“The greatest example of deceptive marketing today is the name that the Democrats have chosen for this piece of legislation,” a research fellow at the Heritage Foundation, EJ Antoni, told Fox News. “It does absolutely nothing to address the problem of inflation.”

The Inflation Reduction Act, which Manchin and Schumer announced Wednesday, is a slimmed down version of President Biden’s Build Back Better Act with a $433 billion price tag, most of which will be spent on climate provisions. The Committee on Taxation estimates that it will raise $739 billion through a variety of measures, including a minimum tax rate on large corporations and enhanced IRS enforcement.

“It does nothing to address the problem of inflation and instead only exacerbates the existing high prices and will drive prices even higher,” Antoni told Fox News. “It’s just adding insult to injury.”

MANCHIN-SCHUMER SPENDING BILL WILL HAVE ‘INDISTINGUISHABLE’ EFFECT ON INFLATION: PENN WHARTON

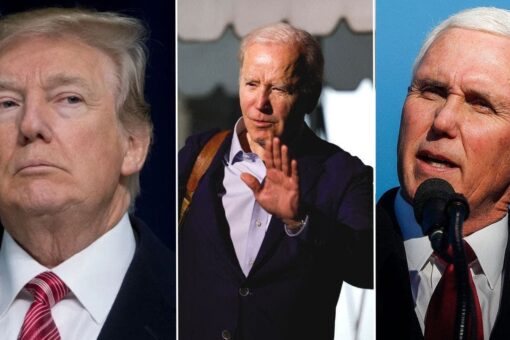

Sen. Joe Manchin has spearheaded the Inflation Reduction Act along with Senate Majority Leader Chuck Schumer.

(The Associated Press)

Supporters have said provisions in the legislation, like deficit reduction and slowing the growth of prescription drug prices, will ease inflation.

“Studies have consistently shown that interest-rate increases and deficit reduction–whether done through higher taxes, lower government spending or a combination of the two as in the Inflation Reduction Act–reduce inflation,” the former chairman of the White House Council of Economic Advisers, Jason Furman, wrote in The Wall Street Journal.

People shop in a supermarket as rising inflation affects consumer prices in Los Angeles, California, U.S., June 13, 2022. REUTERS/Lucy Nicholson

(REUTERS/Lucy Nicholson)

But Antoni said raising taxes to fight surging prices shows a misunderstanding of inflation.

“Inflation is fundamentally too much money relative to the amount of goods and services in the economy,” Antoni told Fox News. “So, if you’re just going to raise taxes, all you’ve done at that point is transfer money from one person to another, the taxpayer to the government.”

WHAT TAX HIKES ARE IN THE MANCHIN-SCHUMER RECONCILIATION BILL?

“But you haven’t actually changed the amount of goods and services relative to the amount of money in the economy,” he continued. “So it does nothing to fight inflation.”

Antoni also said the higher taxes will impact consumers.

Senate Majority Leader Chuck Schumer of New York has said the Inflation Reduction Act lives up to its name.

(AP)

“There will be taxes on energy that will be passed through to the consumer at all different levels, not only in the purchase of energy itself, but because energy affects everything we do and everything we buy,” Antoni said. “Those prices will trickle down into everything else, just as we’ve seen higher prices for diesel and gasoline over the last 18 months trickle down everywhere else into consumers purchases.”

MANCHIN-SCHUMER SPENDING BILL ESTIMATED TO HURT COAL WORKERS THE MOST

Still, Democrats have defended the legislation.

“The only tax increases in the Inflation Reduction Act are a requirement that the biggest corporations pay SOME corporate tax and the closure of an egregious loophole for some billionaire/millionaire investors,” Sen. Chris Murphy tweeted. “This $$ is used to cut drug and energy costs for regular Americans.”

President Joe Biden made a campaign promise not to raise taxes for anyone making less than $400,000.

CLICK HERE TO GET THE FOX NEWS APP

Antoni said the bill would also break Biden’s campaign promise that he wouldn’t raise taxes for anyone making less than $400,000.

“This would just be the latest in a long line of times when Biden has broken his promise not to raise taxes on people earning $400,000 or less a year,” Antoni told Fox News. “Inflation is the biggest tax of all during the Biden administration, and that actually affects the poor and low income earners the most.”

White House officials have denied that the bill would break Biden’s pledge, saying a recent report showing the opposite “is incomplete because it omits the actual benefits that Americans would receive when it comes to prescription drugs [and] when it comes to the lowering energy costs, like utility bills.”