NEWYou can now listen to Fox News articles!

A $739 billion climate change and tax package agreed to by Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Joe Manchin, D-W.Va., is being heralded as a success for Democrats, but the legislation could wind up undercutting the party’s attempts to win back a one-time core constituency: White working-class voters.

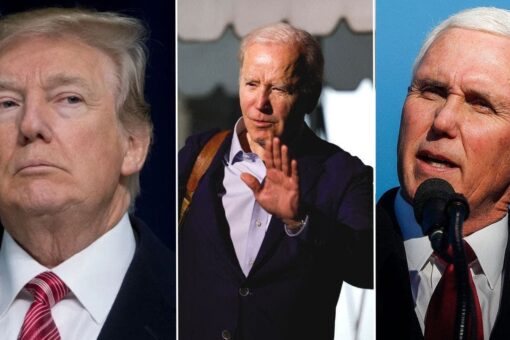

President Biden, who campaigned as a blue-collar union Democrat, has centered his domestic agenda on pushing the legislation through the 50-50 Senate along party lines.

“This is the strongest bill you can pass to lower inflation, cut the deficit, reduce health care costs, tackle the climate crisis, and promote energy security, all the time while reducing the burdens facing working-class and middle-class families,” the president said recently.

President Joe Biden speaks at the United Performance Metals manufacturing facility in Hamilton, Ohio, on May 6, 2022.

(Gaelen Morse/Bloomberg via Getty Images)

GOP critics contend the legislation snubs working-class voters in favor of climate change activists and other special interests within the Democratic Party. They note the bill includes taxpayer-funded subsidies for individuals to purchase electric vehicles, while at the same time imposing a new tax that will hit manufacturing – a sector that disproportionately employs blue-collar workers.

“This bill marks the death of the Democratic Party’s alliance with blue-collar workers,” said Marc Lotter, a former Trump-era White House official who now runs communications for the America First Policy Institute. “Biden campaigned as a working-class guy from Scranton, but he’s governing like a Nantucket liberal.”

Democrats have pitched the bill, which proposes to raise taxes by $739 billion over the next decade, as a salve for inflation. They argue it will lower electricity bills through $443 billion in new climate change subsidies and cap the amount of money that elderly Americans pay out of pocket for some life-saving prescription drugs.

“It’s a bill for America,” said Manchin, who helped spearhead the legislation. “We have an opportunity to lower drug costs for seniors, lower [ObamaCare] health care premiums, increase our energy security, and invest in energy technologies – all while reducing our national debt.”

Sen. Joe Manchin is met by reporters outside the hearing room where he chairs the Senate Committee on Energy and Natural Resources, at the Capitol, July 21, 2022.

(AP Photo/J. Scott Applewhite, File)

Despite the rhetoric, Republicans say the cost of the legislation is likely to be shouldered by blue-collar Americans.

To make all of that new spending possible, Democrats are proposing a new 15% minimum tax on corporations, which the White House estimates will raise $313 billion over the next decade. A nonpartisan congressional panel, the Joint Committee on Taxation, estimates that nearly 50% of the total will come from American manufacturers.

“This is a domestic manufacturing tax, plain and simple,” said Idaho Sen. Mike Crapo, the top Republican on the Senate Finance Committee.

MANCHIN CLAIMS $700B DEAL WITH SCHUMER WON’T ADD TO INFLATION

The National Association of Manufacturers estimates the 15% minimum corporate tax will lead to fewer blue-collar manufacturing jobs over the next decade. That reality stems from the fact that the tax will apply to corporations that list at least $1 billion in profits over a three-year period on their financial statements.

Experts say the income listed on financial statements differs from taxable income because the U.S. tax code allows companies to write off investments made in equipment that is necessary for the business to operate.

“Currently, if you buy a piece of equipment for a million dollars, you don’t have to wait for the asset to depreciate over time, you can reduce your taxable income immediately,” said Chris Netram, the vice president of tax and domestic economic policy at the National Association of Manufacturers. “On the financial statement side, that simply doesn’t exist.”

In 2023 alone, the group estimates, the tax will kill 218,00 jobs and reduce wages across the manufacturing sector by $17 billion.

Worker, welding in a car factory with sparks, manufacturing, industry

The legislation complicates Biden’s efforts to woo White working-class voters. Democrats have been hemorrhaging support among the demographic for nearly a decade.

In 2016, non-college-educated Whites overwhelmingly backed former President Donald Trump over former Secretary of State Hillary Clinton, going for the GOP presidential candidate by the largest margin since Ronald Reagan’s 1980 victory over Jimmy Carter. Although decreasing nationally, non-college-educated Whites are still a sizable population in Pennsylvania, Wisconsin and Michigan – pivotal swing states that voted for Biden narrowly in 2020.

Since taking office, the White House has sought to keep such voters in its column by prioritizing Made in America initiatives and policies friendly to organized labor. The courting was on display during a recent trip to Ohio, where Biden launched an administration effort to stabilize struggling pension funds.

CLICK HERE TO GET THE FOX NEWS APP

“My predecessor had a chance to act, but he didn’t have a commitment to you or the courage to stand up to his own party to get things done,” Biden told a crowd in Cleveland, referencing Trump. “Remember how he was going to help working-class folks?”

Republicans say that such rhetoric means little when compared to the White House’s actions.

“You can’t be a working-class party if you promote policies that hurt the working class,” said Lotter. “Imposing tax hikes that decimate manufacturing jobs is not a winning strategy.”

President Donald Trump arrives at a “Salute to America” event on the South Lawn of the White House, July 4, 2020. (AP Photo/Patrick Semansky)

Democratic strategists, however, defend the White House’s spending bill. They say the package has significant benefits, including allowing Medicare to negotiate the price of prescription drugs, that will help a large portion of Americans.

“To be completely honest, nobody knows what’s in the bill,” said Hassan Martini, the executive director of No Dem Left Behind – a group working to win back rural and working-class communities. “The details and message will be key here: The future of our planet and the way that we live and the way that Americans get their prescription drugs and other health care issues.”